This isn’t breaking news..the wine industry is feeling headwinds that we haven’t dealt with in a while. You can’t go more than a few hours without hearing about oversupply, a changing consumer, a crowded marketplace, lack of price mobility, DTC challenges, poor consumer engagement, etc. Rob McMillan and the SVB Report have done the industry a great service in pointing these out. The storm clouds are there and they are real. You’re either already feeling the choppy waters or will be soon. You’ll find little disagreement about this.

Where you will find differing opinions is whether this is simply a bump in the road or whether the road has fundamentally changed. I’ve spoken with many of the industry’s most senior and respected leaders and there is no consensus here. This is a big, important question and one that may determine the future of many wine companies. My perspective here includes 20+ years of running some of the wine industry’s most recognized brands as well as experience coming out of an industry that was facing similar challenges – there are some interesting learnings for sure.

Bump in the Road?

There is validity in the belief that ‘this too shall pass’. The industry will certainly come back into a supply/demand balance. All agriculturally based industries do at some point and the wine industry has dealt with the ‘eight year cycle’ very efficiently. Short Supply to Balance to Over Supply to Balance back to Short Supply, and so on. Growers will get back to acceptable returns (maybe on less acreage), negociants and wineries will find fewer ‘screaming deals’ on grapes and bulk wine and the supply situation will find its way to balance. While this normal cycle and the large ’18 and ’19 crops can justify the ‘Bump’ argument, slowing demand (without a recession) should cause those in this camp to pause. Assuming that the industry will find its way to equilibrium – it may be that this looks different moving forward. It’s clear that if you subscribe to this theory, you need to believe that the young consumer will behave like their parents did.

Seismic Shift?

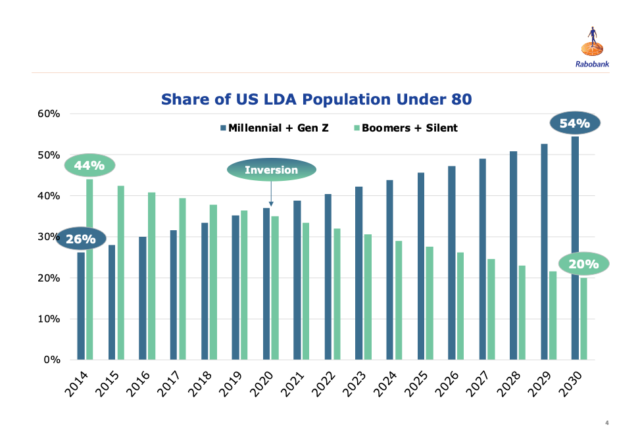

In a growing market, which is the ONLY market that most of us have experienced, there is certainly a ‘rising tide floats all boats’ effect. This can, and has, led to management and business complacency – growth can be a powerful drug and can obscure competitive pressure. Markets, however, seldom grow indefinitely and wine industry growth has certainly taken a pause. Whether this is a short or long term pause is yet to be seen, there are certainly immediate term impacts. Chief amongst these will be significantly heightened competitive activity, market share battles leading to price pressures, pressure from the ‘big players’ to have distributors focus on their brands at the expense of the others, and increasing digital/e-commerce activity to capture the share of stomach of the DTC marketplace. Make no mistake – this is a different battlefield than most wineries have fought on and success requires an astute and agile management team. Consumer shifts lead one to believe that this will be a long term change. Please consider the following graph from my friends at Rabobank:

Clearly, selling the same things to the same people in the same ways, is a recipe to have sales follow the boomers to the grave. 2020 marks the generational inversion point and it’s highly likely that the Millennials and Gen Z’ers relationship with wine will be different than that of their parents. How it will be different is anyone’s guess (and there are many who speculate on this!) but a change in status quo is inevitable. This, in my opinion, represents a seismic shift in the competitive landscape.

A Word of Caution

Previous to entering the wine industry in 1999, I was a beer distributor in the Anheuser-Busch eco-system. This provided me with an amazing window into one of the world’s preeminent beverage alcohol marketing machines. I harken back however to a meeting that I was participating in with August Busch III, the CEO of the mega-brewer at the time, in July 1993. Mr Busch, a highly respected captain of industry, was leading the meeting. The topic was the surging micro-brewery trend on the West Coast. Younger consumers at the time were clearly moving away from ‘American lager’ (Bud, Miller, Coors) and toward more flavorful ales produced by smaller, artisanal brewers. Distributors had a ‘street level’ perspective on this and understood that this was a fundamental change in consumer behavior. The executives from St. Louis however dismissed the trend as a short-term blip that didn’t even register on their weekly market share reports. One of the AB executives commented that “We spill more beer everyday than they sell in an entire year.” While they made investments in some craft brewers, they never fully embraced the changing consumer until it was too late. Budweiser, Bud Light (and the products of Miller Coors) have been losing volume in the shrinkage of the American lager category for years now. Let’s not make the same mistake in the wine industry. Let’s ensure that we do our best to recognize and react to the inevitable changes that result from a new consumer.

The Path Forward

We know a lot about the headwinds that face the industry – they are well chronicled on a daily basis in the wine press. How these headwinds impact the industry and particularly individual wine companies within it, is a story that will unfold in the coming months and years. Uncertainty breeds anxiety, but there are a few things that seem certain:

- There will be a premium on experienced and agile management teams. These folks will ensure that their companies are positioned for success and react quickly and decisively when a course change is required. If you can’t afford them, look to ‘fractional’ solutions to provide the expertise.

- The role of the marketer within our organizations (particularly the digital marketer) will become a critical success factor. The ability to get differentiating and personalized messages to the right people in the right place at the right time will be critical in this age of short attention spans and brand proliferation.

- The quest for ‘perfection’ in wine quality, while important, will not be a differentiator for most of us (sorry winemakers!). In a battle for scarce resources, ensure that your demand and revenue engine has enough fuel to churn through the choppy waters. This may require a re-allocation of resources within the organization to align yourself with the new reality, whatever that may be.

In sum, there is no crystal ball for what lies ahead. Wineries will need to determine how they position themselves to thrive in the coming years. My bet would be on those with the best management teams and the best marketers.

Expert Editorial

By Steve Tamburelli, Co-Founder / Vinitas Wine Group

By Steve Tamburelli, Co-Founder / Vinitas Wine Group

One of the most respected names in the Napa Valley wine industry, Steve Tamburelli has earned a reputation for helping to write exciting new chapters in the stories of some of the valley’s most iconic wineries. Under his leadership, names like Stags Leap Wine Cellars, Chappellet, and Clos du Val were brought to new levels of quality, visibility, and unprecedented success. In his 20+ years of senior management, he has developed and executed comprehensive business strategies, provided focused guidance in the areas of product portfolio and production, secured new financing and successfully developed and managed multi-channel sales strategies (3-Tier, DTC, Export). (more)

Tamburelli will be talking about Working with Outside Sales & Marketing Companies to Drive Revenue at the 3 Tier Wine Symposium, May 7, 2020 in Santa Rosa